Cleaning Products Vat Rate Uk . Some things are exempt from vat, such as. the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). — when a vat registered business issues an invoice to their customer, they must seek to ensure that they charge the correct rate of vat. Some things are exempt from vat, such as postage stamps and some. in the united kingdom, there is a standard vat rate of 20% on cleaning products. vat rates in the united kingdom. Cleaning services, including the materials used (e.g. there are five categories of product or service for vat. check the vat rates on different goods and services. The reduced rate is 5%, which. In 2020, owing to the ravaging effects of the. yes, there is vat on cleaning products in the united kingdom. The standard rate is 20%, and it applies to most common products, services, and goods.

from resolve.co.uk

Cleaning services, including the materials used (e.g. — when a vat registered business issues an invoice to their customer, they must seek to ensure that they charge the correct rate of vat. Some things are exempt from vat, such as postage stamps and some. yes, there is vat on cleaning products in the united kingdom. the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). vat rates in the united kingdom. The standard rate is 20%, and it applies to most common products, services, and goods. check the vat rates on different goods and services. in the united kingdom, there is a standard vat rate of 20% on cleaning products. Some things are exempt from vat, such as.

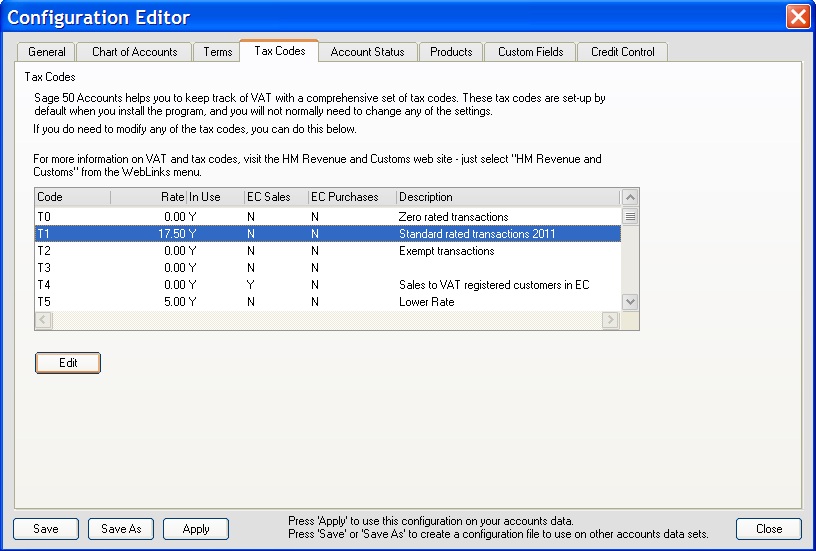

How to change VAT rates in Sage Resolve

Cleaning Products Vat Rate Uk Some things are exempt from vat, such as postage stamps and some. Some things are exempt from vat, such as. yes, there is vat on cleaning products in the united kingdom. in the united kingdom, there is a standard vat rate of 20% on cleaning products. vat rates in the united kingdom. check the vat rates on different goods and services. The reduced rate is 5%, which. — when a vat registered business issues an invoice to their customer, they must seek to ensure that they charge the correct rate of vat. there are five categories of product or service for vat. The standard rate is 20%, and it applies to most common products, services, and goods. In 2020, owing to the ravaging effects of the. Some things are exempt from vat, such as postage stamps and some. Cleaning services, including the materials used (e.g. the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%).

From hellotax.com

VAT rates in Europe 2023 Definition, Actual ValueAddedTax Rates Cleaning Products Vat Rate Uk — when a vat registered business issues an invoice to their customer, they must seek to ensure that they charge the correct rate of vat. yes, there is vat on cleaning products in the united kingdom. Cleaning services, including the materials used (e.g. The standard rate is 20%, and it applies to most common products, services, and goods.. Cleaning Products Vat Rate Uk.

From resolve.co.uk

How to change VAT rates in Sage Resolve Cleaning Products Vat Rate Uk In 2020, owing to the ravaging effects of the. in the united kingdom, there is a standard vat rate of 20% on cleaning products. — when a vat registered business issues an invoice to their customer, they must seek to ensure that they charge the correct rate of vat. Some things are exempt from vat, such as. The. Cleaning Products Vat Rate Uk.

From cruseburke.co.uk

How Does VAT Work in the UK? CruseBurke Cleaning Products Vat Rate Uk yes, there is vat on cleaning products in the united kingdom. The reduced rate is 5%, which. Cleaning services, including the materials used (e.g. The standard rate is 20%, and it applies to most common products, services, and goods. there are five categories of product or service for vat. the standard rate of vat increased to 20%. Cleaning Products Vat Rate Uk.

From www.keybusinessconsultants.co.uk

VAT Rates 202122 Which Goods and Services Are Exempt From VAT? Cleaning Products Vat Rate Uk In 2020, owing to the ravaging effects of the. the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). vat rates in the united kingdom. in the united kingdom, there is a standard vat rate of 20% on cleaning products. Cleaning services, including the materials used (e.g. Some things are exempt from vat,. Cleaning Products Vat Rate Uk.

From www.invoicingtemplate.com

VAT Invoicing Sample with 2 Separate Rates Cleaning Products Vat Rate Uk — when a vat registered business issues an invoice to their customer, they must seek to ensure that they charge the correct rate of vat. The reduced rate is 5%, which. yes, there is vat on cleaning products in the united kingdom. Some things are exempt from vat, such as postage stamps and some. check the vat. Cleaning Products Vat Rate Uk.

From www.pinterest.com

Cleaning Service Price List How to create a Cleaning Service Price Cleaning Products Vat Rate Uk there are five categories of product or service for vat. yes, there is vat on cleaning products in the united kingdom. The standard rate is 20%, and it applies to most common products, services, and goods. The reduced rate is 5%, which. — when a vat registered business issues an invoice to their customer, they must seek. Cleaning Products Vat Rate Uk.

From vatsense.com

VAT Sense Free UK & EU VAT Number Validation API, EU VAT rates API Cleaning Products Vat Rate Uk the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). The reduced rate is 5%, which. Some things are exempt from vat, such as. Cleaning services, including the materials used (e.g. in the united kingdom, there is a standard vat rate of 20% on cleaning products. vat rates in the united kingdom. Some. Cleaning Products Vat Rate Uk.

From www.sage.com

UK VAT rates and VAT FAQs Sage Advice United Kingdom Cleaning Products Vat Rate Uk vat rates in the united kingdom. Cleaning services, including the materials used (e.g. The reduced rate is 5%, which. The standard rate is 20%, and it applies to most common products, services, and goods. there are five categories of product or service for vat. Some things are exempt from vat, such as. yes, there is vat on. Cleaning Products Vat Rate Uk.

From ember.co

How much is VAT? A guide to UK VAT rates Cleaning Products Vat Rate Uk there are five categories of product or service for vat. The reduced rate is 5%, which. Some things are exempt from vat, such as. vat rates in the united kingdom. Cleaning services, including the materials used (e.g. — when a vat registered business issues an invoice to their customer, they must seek to ensure that they charge. Cleaning Products Vat Rate Uk.

From help.invoicing-software.com

UK HMRC VAT Reverse Charge Support SliQ Invoicing Online Help Cleaning Products Vat Rate Uk vat rates in the united kingdom. yes, there is vat on cleaning products in the united kingdom. the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). in the united kingdom, there is a standard vat rate of 20% on cleaning products. there are five categories of product or service for. Cleaning Products Vat Rate Uk.

From www.effective-accounting.co.uk

VAT The Basics Cleaning Products Vat Rate Uk Some things are exempt from vat, such as. Cleaning services, including the materials used (e.g. The standard rate is 20%, and it applies to most common products, services, and goods. Some things are exempt from vat, such as postage stamps and some. In 2020, owing to the ravaging effects of the. the standard rate of vat increased to 20%. Cleaning Products Vat Rate Uk.

From simpleglobal.com

Understanding European VAT Rates Simple Global Cleaning Products Vat Rate Uk in the united kingdom, there is a standard vat rate of 20% on cleaning products. Cleaning services, including the materials used (e.g. — when a vat registered business issues an invoice to their customer, they must seek to ensure that they charge the correct rate of vat. The standard rate is 20%, and it applies to most common. Cleaning Products Vat Rate Uk.

From taxfoundation.org

VAT Rates in Europe ValueAdded Tax European Rankings Cleaning Products Vat Rate Uk check the vat rates on different goods and services. The standard rate is 20%, and it applies to most common products, services, and goods. Cleaning services, including the materials used (e.g. Some things are exempt from vat, such as. Some things are exempt from vat, such as postage stamps and some. yes, there is vat on cleaning products. Cleaning Products Vat Rate Uk.

From antinsky.com

Vat Cleaning Function Cleaning Products Vat Rate Uk in the united kingdom, there is a standard vat rate of 20% on cleaning products. Some things are exempt from vat, such as. the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). yes, there is vat on cleaning products in the united kingdom. — when a vat registered business issues an. Cleaning Products Vat Rate Uk.

From limbodivision209.com

UK VAT rate explains LimboDivision209 Cleaning Products Vat Rate Uk vat rates in the united kingdom. Cleaning services, including the materials used (e.g. check the vat rates on different goods and services. The standard rate is 20%, and it applies to most common products, services, and goods. the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). — when a vat registered. Cleaning Products Vat Rate Uk.

From www.xero.com

What is VAT and How Much is it? VAT Guide Xero UK Cleaning Products Vat Rate Uk the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). Some things are exempt from vat, such as. Cleaning services, including the materials used (e.g. Some things are exempt from vat, such as postage stamps and some. — when a vat registered business issues an invoice to their customer, they must seek to ensure. Cleaning Products Vat Rate Uk.

From simpleinvoice17.net

16+ Invoice Template Uk No Vat Pictures Invoice Template Ideas Cleaning Products Vat Rate Uk The standard rate is 20%, and it applies to most common products, services, and goods. in the united kingdom, there is a standard vat rate of 20% on cleaning products. check the vat rates on different goods and services. — when a vat registered business issues an invoice to their customer, they must seek to ensure that. Cleaning Products Vat Rate Uk.

From businessfinancing.co.uk

What Does Net Of VAT Mean In The UK? 2024 Guide Cleaning Products Vat Rate Uk the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). check the vat rates on different goods and services. Some things are exempt from vat, such as. yes, there is vat on cleaning products in the united kingdom. there are five categories of product or service for vat. The reduced rate is. Cleaning Products Vat Rate Uk.